property taxes las vegas nevada records

Recorded Documents and Marriage Records. View Anyones Arrests Addresses Phone Numbers Aliases Hidden Records More.

3115 Las Vegas Blvd N Las Vegas Nv 89115 Las Vegas Retail Loopnet Com

To calculate the tax multiply the assessed value by the applicable tax rate.

. Property Account Inquiry - Search Screen. Start Your Search Here. Show current parcel number record.

Start Your Search Here. About Assessor and Property Tax Records in Nevada. Look Up Current Past Tax Amounts Along with the Countys Value Assessment.

Account Search Dashes Must be Entered. Property Reports Asset Finder Research Leads Radius Search options. Several government offices in Las Vegas and Nevada state maintain Property Records which are a valuable tool for understanding the history of a property finding property owner information.

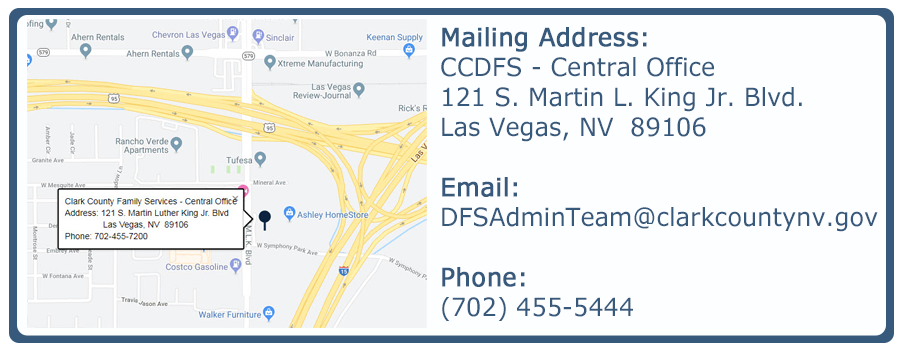

702 455-4323 Fax 702 455-5969. Show present and prior owners of the parcel. Business Opportunities Procurement.

Las Vegas NV 89106. Counties in Nevada collect an average of 084 of a propertys assesed fair. Apply for Business License.

Ad Find property ownership and title history look into sale prices mortgages foreclosures. Las Vegas Nevada 89106. If you are a new visitor to our site please scroll down this page for important information regarding the Assessor transactions.

Ad Find Anyones Nevada Property Records. Get In-Depth Property Reports Info You May Not Find On Other Sites. Ad Retrieve Property Tax Records Connected to Any Address.

Nevada real and personal property tax records are managed by the County Assessor in each county. Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada. Land and land improvements are.

Office of the County Treasurer. Ad Retrieve Property Tax Records Connected to Any Address. Office of the County Treasurer.

Phone 702455-4323 Fax 702455-5969. 500 S Grand Central. 500 South Grand Central Parkway 1st Floor.

500 South Grand Central Parkway Las Vegas NV 89155. Elements and Applications Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes. Clark County Treasurers Office Suggest Edit.

If you do not receive your tax bill by August 1st each year please use the automated telephone system. Find the best Property tax records around Las VegasNV and get detailed driving directions with road conditions live traffic updates and reviews of local business along the way. Search Clark County recorded.

The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. Treasurer - Real Property Taxes. 3 rows Las Vegas Property Tax Collections Total Property Taxes.

Ad Connect To The People Places In Your Neighborhood Beyond. Look Up Current Past Tax Amounts Along with the Countys Value Assessment. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

70000 assessed value x 032782 tax rate per hundred dollars 229474 for the fiscal year.

25 Things To Know About Living In Las Vegas Extra Space Storage

Nevada Ranked At 9 For Lowest Property Taxes Las Vegas Review Journal

5755 Spring Mountain Rd Las Vegas Nv 89146 Siena Plaza Loopnet Com

What S The Property Tax Outlook In Las Vegas Mansion Global

7401 W Charleston Blvd Las Vegas Nv 89117 High Profile Office Opportunity Loopnet Com

3686 Golden Sunset Ct North Las Vegas Nv 89115 Realtor Com

3395 E Tropicana Ave Las Vegas Nv 89121 Plaza With National Tenants Walmart Shadow Loopnet Com